Key Takeaways

- Building a digital bank like N26 requires more than UI—it demands a ledger-first, compliance-driven banking architecture.

- The U.S. neobanking market is projected to grow from USD 34.56B to USD 263.67B by 2032, making early, scalable entry critical.

- KYC, AML, PCI-DSS, SOC-2, and data residency controls are non-negotiable technical requirements from day one.

- Embedded finance (wallets, payments, BNPL, card issuing) is now a core growth lever, not an optional feature.

- Partnering with an experienced digital banking app development company reduces regulatory risk and time-to-market.

N26 was a leading digital bank that offered mobile-first banking services in the US. However, the bank ceased operations in the States in 2022 and returned to the European market, mainly due to strategic misalignment and high investment. It created opportunities for new players to enter the digital banking sector, who can offer more focused operations around the USA.

Digital banks, often referred to as neobanks, aim to provide a mobile-first, digital interface for banking solutions. The steadily increasing use of high technology and demand for personalized banking solutions, especially in the western and northeastern parts of the United States, creates a perfect scenario for this business model.

Moreover, the US Neobanking market is expected to reach USD 263.67 billion in 2032, a 27.31% increase from the current USD 34.56 billion market.

Due to the nature of operations of neobanks, they see a rapid adoption rate, especially among tech-savvy millennials, small busines owners, and informal enterprises. For this reason, enterprises are now looking to bridge the $5.7 trillion global SME finance gap and provide the hyper-personalized experiences today’s users demand.

Developing a neobank app like N26 requires practical knowledge and deep expertise to ensure market success. This can be achieved by partnering with industry leaders experienced in banking app development. In this article, we analyzed the top app development companies that provide digital banking and neobanking apps to enterprises.

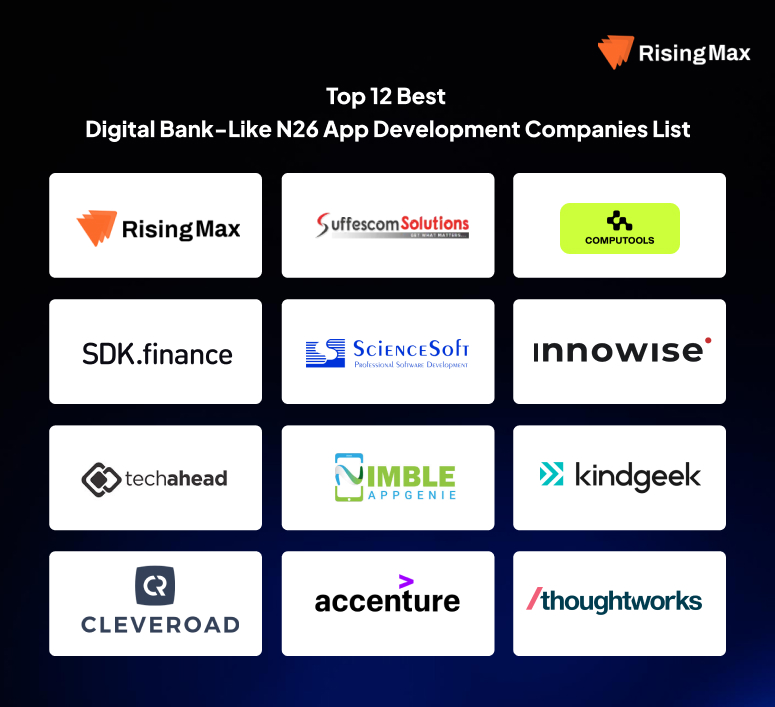

Top 12 Best Digital Bank like N26 App Development Companies List

- RisingMax Inc

- Suffescom Solutions

- Computools

- SDK finance

- ScienceSoft

- Innowise Group

- TechAhead

- Nimble AppGenie

- KindGeek

- Cleveroad

- Accenture (Fintech and Digital Banking Practice)

- ThoughtWorks

In neobanking, architecture decisions made early define scalability, compliance, and profitability later. Choose your development partner with the same rigor as your banking strategy.

Neobanking Market Size & Potential

Multiple industry analysts project the global neobanking market to multiply many times over this decade (estimates vary by source and methodology), underscoring the urgency for fintech founders to move from prototype to production-grade platforms that can scale internationally.

American Market (U.S.)

The U.S. neobanking market is rapidly expanding from a sizeable base: one market analysis projects growth from roughly USD 34.56 billion (2024) to USD 263.67 billion by 2032, implying sustained double-digit CAGR and strong demand for mobile-first, low-cost banking solutions. This expansion is driven by consumer preference for real-time payments, fintech partnerships, and lower-fee banking models, all core revenue levers for new neobanks.

European Market (EU & UK)

Europe’s neobank adoption benefits from open-banking mandates, SEPA instant payments, and high smartphone penetration. Market estimates place the European neobanking market at ~USD 28B (2024) with forecasts targeting roughly USD 88B by 2030, reflecting strong growth potential for regionally compliant, UX-driven banking apps. These structural enablers make Europe especially fertile for neobanks that prioritize regulatory integration and cross-border payments.

Top Digital Bank like N26 Development Companies in Detail

1. RisingMax Inc

| Feature | Details |

| Years of Experience | 13+ Years |

| Number of Employees | 250+ |

| Location | New York, USA |

| Projects Completed | 1,000+ |

| Global Recognition | Featured among the top US app & fintech developers |

| Clutch Rating | 5.0 / 5.0 |

RisingMax Inc. is a fintech-focused software engineering company specializing in digital banking, neobanking, and financial platform development for the U.S. and global markets. The company designs and builds regulation-ready banking applications that align with modern neobank architectures, API-first, cloud-native, and security-centric.

Their digital banking solutions typically include core banking integrations, KYC/AML workflows, real-time transaction processing, digital wallets, card issuing systems, and embedded finance capabilities. RisingMax operates with a strong emphasis on scalability, compliance alignment (PCI-DSS, SOC 2 readiness), and performance under high transaction loads, making it suitable for both early-stage neobanks and growth-stage fintech platforms.

Strengths

- Neobank-Ready Architecture: Proven experience in building mobile-first banking apps with microservices architecture, REST/GraphQL APIs, and event-driven systems.

- Compliance-Focused Development: Strong understanding of US fintech regulations, including KYC, AML, PCI-DSS, and secure data handling practices.

- End-to-End Digital Banking Stack: Capabilities across core banking integration, payment gateways, wallet systems, card management, and admin dashboards.

- Agile & Product-Led Delivery: Uses Agile/Scrum methodology, enabling rapid MVP launches followed by iterative compliance and feature scaling.

- Global Recognition & Trust: Recognized among top fintech and app development companies, with strong client ratings and repeat enterprise engagements.

Best For

- Fintech startups launching a neobank or digital wallet in the U.S.

- Entrepreneurs building N26-like digital banking apps with localized compliance

- Financial institutions are modernizing legacy systems into mobile-first banking platforms

- Businesses looking to embed banking features (payments, wallets, cards) into existing products

USPs of RisingMax Inc for Developing Digital Bank & Neobanking Apps

- Neobank-First Engineering Approach

Builds digital banks using API-first, cloud-native, and microservices-based architectures, ensuring scalability from MVP to mass adoption. - US Market & Compliance Alignment

Strong understanding of U.S. fintech regulations, including KYC, AML, PCI-DSS, SOC 2 readiness, and secure data handling practices. - End-to-End Digital Banking Capabilities

Expertise across core banking integrations, digital wallets, card issuing, payment gateways, and admin control systems.

- High-Performance Transaction Systems

Proven ability to develop platforms that handle real-time transactions, concurrency, and high-volume user activity without performance degradation. - Security-by-Design Development

Implements tokenization, encryption at rest and in transit, secure authentication, and fraud-prevention mechanisms as default standards. - MVP-to-Scale Execution Model

Efficient at launching compliance-ready MVPs and scaling them into full-fledged neobanking platforms through iterative development. - Embedded Finance Enablement

Supports embedded banking, payments, and wallet features for fintechs and non-banking platforms.

2. Suffescom Solutions

| Feature | Details |

| Years of Experience | 12+ Years |

| Number of Employees | 201–500 |

| Location | USA, India, UAE |

| Projects Completed | 1,500+ |

| Global Recognition | Clutch, G2, GoodFirms, DesignRush |

| Clutch Rating | 4.8 / 5.0 |

Suffescom Solutions is a digital product engineering firm with strong execution depth in neobanking and fintech application development. The company focuses on building custom digital banking platforms that are scalable, API-driven, and aligned with modern compliance and security expectations.

Their work spans mobile banking apps, digital wallets, payment orchestration layers, admin panels, and fintech dashboards, with an emphasis on performance, user experience, and regulatory readiness. Suffescom’s engineering approach is well-suited for fintech products that require rapid market entry without compromising architectural integrity.

Strengths

- Fintech-Centric Delivery: Hands-on experience with KYC/AML flows, secure authentication, role-based access, and transaction lifecycle management.

- Scalable Architecture Expertise: Builds cloud-native systems using microservices, API gateways, and modular backend design.

- Recognized Industry Presence: Acknowledged by platforms like Clutch, G2, GoodFirms, and DesignRush for fintech and mobile development.

- Agile Product Execution: Strong at MVP-to-scale transitions using iterative sprint-based delivery.

Best For

- Startups launching custom neobank or wallet apps

- Enterprises developing fintech extensions or embedded banking features

- Businesses seeking secure, scalable digital banking solutions under tight timelines

3. Computools

| Feature | Details |

| Years of Experience | 12+ Years |

| Number of Employees | 500+ |

| Location | USA, Europe |

| Projects Completed | 400+ |

| Global Recognition | IAOP Global Outsourcing 100 |

| Clutch Rating | 4.9 / 5.0 |

Computools is a global software engineering company with deep capabilities in digital banking and fintech platform development, serving both startups and enterprise-grade financial institutions. The company specializes in building high-load, transaction-intensive banking systems that demand resilience, scalability, and security by design.

Their digital banking work often involves core banking integrations, payment processing engines, real-time analytics, and omnichannel banking interfaces, all developed using a cloud-native, API-first approach. Computools positions itself strongly in projects where performance optimization, system interoperability, and long-term maintainability are critical.

Strengths

- Enterprise-Grade Engineering: Proven expertise in distributed systems, microservices, and fault-tolerant architectures for financial platforms.

- Data & Analytics Depth: Strong focus on real-time reporting, fraud detection logic, and data-driven banking workflows.

- Global Delivery Model: Experience supporting fintech products across North America and Europe.

- Industry Recognition: Listed in IAOP Global Outsourcing 100, reflecting consistent delivery excellence.

Best For

- Fintech companies building scalable neobanking platforms

- Banks modernizing legacy core systems

- Enterprises requiring high-performance digital banking infrastructure

4. SDK finance

| Feature | Details |

| Years of Experience | 12+ Years |

| Number of Employees | 50+ |

| Location | Lithuania (Global Operations) |

| Projects Completed | 100+ Fintech Deployments |

| Global Recognition | Modular digital banking platform provider |

| Clutch Rating | N/A |

SDK.finance is a fintech platform provider focused on accelerating the launch of digital banks, neobanks, and payment-centric financial products. Unlike traditional custom development firms, SDK.finance offers a modular, white-label core banking platform that enables faster deployment of banking apps with reduced engineering overhead.

Their platform is designed around API-driven architecture, supporting use cases such as digital wallets, card issuing, peer-to-peer payments, and multi-currency accounts. This approach makes SDK.finance particularly attractive for fintech founders seeking speed-to-market without sacrificing regulatory readiness.

Strengths

- Pre-Built Banking Modules: Ready-to-use components for accounts, payments, cards, ledgers, and compliance workflows.

- API-First & Modular Design: Enables seamless integration with KYC providers, payment gateways, and third-party fintech services.

- Cost & Time Efficiency: Significantly reduces development timelines compared to building a core banking system from scratch.

- Fintech-Specific Focus: Dedicated expertise in neobanking and payment ecosystems.

Best For

- Startups launching neobanks or digital wallet platforms

- Fintech companies prioritizing rapid market entry

- Businesses building white-label banking or payment solutions

5. ScienceSoft

| Feature | Details |

| Years of Experience | 35+ Years |

| Number of Employees | 700+ |

| Location | USA, Europe |

| Projects Completed | 1,000+ |

| Global Recognition | Gartner & Deloitte recognized |

| Clutch Rating | 4.8 / 5.0 |

ScienceSoft is a long-established IT consulting and software engineering firm with mature capabilities in digital banking and enterprise fintech solutions. The company supports banks and financial institutions in building secure, regulation-aware digital banking platforms, often as part of large-scale modernization or transformation initiatives.

Their digital banking engagements typically involve core banking modernization, omnichannel banking systems, payment platforms, risk management modules, and data analytics layers, delivered with a strong emphasis on stability, compliance, and long-term operability.

Strengths

- Enterprise & Regulatory Expertise: Deep experience working under PCI-DSS, SOC 2, GDPR, and financial data security frameworks.

- Legacy-to-Digital Modernization: Strong at transforming monolithic banking systems into service-oriented or microservices-based architectures.

- Security-First Engineering: Advanced capabilities in secure authentication, data encryption, and fraud-prevention mechanisms.

- Industry Recognition: Trusted by global enterprises and acknowledged by leading industry analysts.

Best For

- Banks modernizing legacy digital banking infrastructure

- Enterprises building compliance-heavy fintech platforms

- Financial institutions prioritizing security, scalability, and long-term stability

6. Innowise Group

| Feature | Details |

| Years of Experience | 15+ Years |

| Number of Employees | 2,000+ |

| Location | USA, Europe |

| Projects Completed | 2,000+ |

| Global Recognition | Top enterprise & fintech vendor |

| Clutch Rating | 4.7 / 5.0 |

Innowise Group is a large-scale software engineering partner with a strong footprint in digital banking and fintech product development. The company delivers end-to-end neobanking solutions, ranging from customer-facing mobile banking applications to complex backend systems that handle transactions, compliance, and reporting.

Innowise is frequently engaged in projects requiring high scalability, cross-border payment support, and integration with third-party financial services, making them well-suited for fintech products operating across multiple regions.

Strengths

- High-Capacity Engineering Teams: Ability to staff large, specialized fintech teams covering backend, mobile, security, and DevOps.

- Advanced Banking Use Cases: Experience with open banking APIs, digital wallets, lending modules, and real-time payment systems.

- Cloud & DevOps Maturity: Strong emphasis on CI/CD pipelines, containerization, and cloud infrastructure optimization.

- Global Delivery Experience: Proven track record across Europe, North America, and emerging fintech markets.

Best For

- Fintech firms building scalable neobanking platforms

- Enterprises launching multi-region digital banking products

- Organizations requiring large, distributed fintech development teams

7. TechAhead

| Feature | Details |

| Years of Experience | 15+ Years |

| Number of Employees | 250+ |

| Location | USA, India |

| Projects Completed | 1,500+ |

| Global Recognition | Gartner, Forrester featured |

| Clutch Rating | 4.8 / 5.0 |

TechAhead is a digital product engineering company with notable experience in mobile-first banking and fintech application development. The firm focuses on designing consumer-grade digital banking apps that combine strong UX with secure, scalable backend systems.

Their fintech portfolio typically covers mobile banking applications, digital wallets, payment aggregation layers, and customer engagement platforms, built to handle real-time transactions and high user concurrency. TechAhead’s approach balances product design precision with engineering reliability, making them a practical choice for fintech brands competing on user experience.

Strengths

- UX-Driven Banking Apps: Strong capabilities in intuitive banking interfaces, onboarding flows, and customer journey optimization.

- Secure Mobile Engineering: Implements token-based authentication, encrypted data storage, and secure API communication.

- Agile Product Development: Efficient MVP development using iterative sprint models with rapid feature validation.

- Industry Recognition: Featured by leading analyst and review platforms for fintech and mobile development.

Best For

- Fintech startups launching mobile-centric neobank apps

- Businesses prioritizing user experience in digital banking

- Companies building consumer-facing fintech products under tight timelines

8. Nimble AppGenie

| Feature | Details |

| Years of Experience | 10+ Years |

| Number of Employees | 100–250 |

| Location | USA, India |

| Projects Completed | 500+ |

| Global Recognition | Top-rated startup app developer |

| Clutch Rating | 4.7 / 5.0 |

Nimble AppGenie is a digital engineering firm focused on building mobile-first fintech and neobanking applications for startups and mid-sized enterprises. The company emphasizes lean development and rapid prototyping, helping fintech teams validate digital banking concepts before scaling.

Their neobanking work commonly includes wallet-based payment systems, user onboarding flows, transaction dashboards, and role-based admin panels, all designed with performance and security in mind. Nimble AppGenie is often selected for projects where speed, flexibility, and cost-efficiency are critical without sacrificing core banking functionality.

Strengths

- MVP-Focused Fintech Delivery: Strong expertise in launching minimum viable neobank products quickly.

- Mobile & Backend Balance: Experience building secure mobile apps paired with scalable backend services.

- API Integration Capability: Integrates smoothly with payment gateways, KYC providers, and third-party fintech APIs.

- Agile Execution Model: Uses iterative development cycles to refine features based on early user feedback.

Best For

- Startups testing new digital banking or wallet concepts

- Businesses seeking cost-effective neobank MVP development

- Teams requiring fast go-to-market fintech solutions

9. KindGeek

| Feature | Details |

| Years of Experience | 8+ Years |

| Number of Employees | 50–200 |

| Location | Europe |

| Projects Completed | 300+ |

| Global Recognition | Blockchain & fintech specialist |

| Clutch Rating | 4.6 / 5.0 |

KindGeek is a boutique software development company with focused expertise in fintech, neobanking, and blockchain-enabled financial platforms. The firm works closely with startups and product-led companies to build secure, modular digital banking systems that can evolve as regulatory and market requirements change.

In neobanking projects, KindGeek typically delivers payment flows, digital wallets, user identity layers, and backend services designed for flexibility rather than monolithic scale. Their strength lies in crafting clean, maintainable architectures that support rapid feature iteration.

Strengths

- Product-Centric Engineering: Strong alignment with lean fintech development and iterative product validation.

- Security & Identity Focus: Experience implementing secure authentication, permission management, and transaction safeguards.

- Blockchain & Fintech Crossover: Ability to integrate distributed ledger components where transparency or traceability is required.

- Startup-Focused Delivery: Comfortable working with early-stage neobanks and fintech innovators.

Best For

- Startups building modular neobank platforms

- Fintech products requiring flexible architecture and fast iteration

- Teams exploring blockchain-adjacent digital banking use cases

10. Cleveroad

| Feature | Details |

| Years of Experience | 10+ Years |

| Number of Employees | 100–250 |

| Location | Europe |

| Projects Completed | 500+ |

| Global Recognition | Clutch Global Leader |

| Clutch Rating | 4.8 / 5.0 |

Cleveroad is a digital engineering company with solid experience in fintech and digital banking application development, serving both startups and established financial businesses. The company focuses on delivering reliable, user-friendly banking solutions backed by stable backend systems.

Their neobanking engagements often involve mobile banking apps, digital wallets, payment processing modules, and administrative dashboards, built with attention to performance, scalability, and long-term support. Cleveroad is frequently involved in projects where technical clarity and predictable delivery are as important as innovation.

Strengths

- Structured Engineering Process: Applies well-defined development workflows to reduce risk in financial software projects.

- Mobile & Backend Expertise: Balanced proficiency across frontend UX and backend transaction handling.

- Cloud-Ready Solutions: Experience deploying fintech systems on modern cloud infrastructure with scalability in mind.

- Market Recognition: Regularly featured on Clutch and industry rankings for fintech development services.

Best For

- Fintech startups building stable digital banking applications

- Companies modernizing existing banking apps

- Businesses seeking predictable delivery for fintech projects

11. Accenture (Fintech and Digital Banking Practice)

| Feature | Details |

| Years of Experience | 30+ Years |

| Number of Employees | 700,000+ |

| Location | Global (HQ: Ireland) |

| Projects Completed | Thousands |

| Global Recognition | Fortune Global 500 |

| Clutch Rating | N/A |

Accenture operates at the intersection of strategy, technology, and large-scale financial transformation, making it a key partner for banks and enterprises undertaking complex digital banking and neobanking initiatives.

Rather than focusing on standalone app builds, Accenture delivers enterprise-grade digital banking ecosystems, covering core banking modernization, cloud migration, open banking enablement, and data-driven financial platforms. Their digital banking engagements often span multi-year, multi-region programs, integrating legacy systems with modern cloud-native architectures while ensuring regulatory continuity.

Strengths

- Enterprise Banking Transformation: Deep experience in core banking replacement, platform consolidation, and large-scale fintech transformation.

- Regulatory & Risk Expertise: Strong capabilities across global banking regulations, risk management, and compliance automation.

- Advanced Technology Stack: Leverages AI, analytics, cloud, and open banking frameworks at enterprise scale.

- Global Recognition: A Fortune Global 500 company trusted by leading banks worldwide.

Best For

- Large banks pursuing end-to-end digital banking transformation

- Enterprises launching complex, compliance-heavy fintech platforms

- Organizations requiring global delivery and strategic consulting depth

12. ThoughtWorks

| Feature | Details |

| Years of Experience | 30+ Years |

| Number of Employees | 8,000+ |

| Location | Global (HQ: USA) |

| Projects Completed | Thousands |

| Global Recognition | Agile & Digital Transformation Leader |

| Clutch Rating | N/A |

ThoughtWorks is a global technology consultancy known for shaping modern digital banking platforms through engineering excellence and architectural rigor. In the fintech and neobanking space, the company is often engaged in complex product builds and large-scale system transformations where adaptability and long-term resilience are critical.

ThoughtWorks works closely with banks and fintech firms to design cloud-native, API-driven banking systems, often incorporating microservices, event-driven architectures, and continuous delivery pipelines to support rapid change.

Strengths

- Architecture-Led Development: Strong emphasis on domain-driven design, microservices, and evolutionary architectures for financial systems.

- Agile & DevOps Leadership: Recognized pioneers in Agile, DevOps, and continuous delivery practices.

- Open Banking Expertise: Experience implementing open banking APIs and platform ecosystems.

- Industry Credibility: Widely respected for influencing modern software engineering standards globally.

Best For

- Banks building future-ready digital banking platforms

- Fintech firms need highly adaptable, scalable architectures

- Enterprises prioritizing engineering quality over short-term speed

Our Selection Criteria (what actually matters for neobank projects)

Since developing a digital banking app like N26 is a complex process. Therefore, to ensure the project’s success, make sure that you partner with an experienced development partner who understands the complex architecture and global and especially local regulations well.

Product & Platform Expertise

Proven delivery of full banking stacks (accounts, ledgers, card issuing, settlement, reconciliation). Look for references showing end-to-end releases, not isolated UI builds.

Architecture & Scalability, experience with microservices, event-driven systems, CQRS, eventual consistency patterns, and horizontal scale for transaction throughput and reconciliation.

UX / UI Excellence

Demonstrated fintech UX and frictionless KYC flows, progressive disclosure for permissions, transaction context, and latency-optimized mobile flows.

Security, Compliance & Licensing Support

Hands-on implementation of PCI-DSS, SOC-2 practices, encryption (at rest/in transit), MFA, and integration with KYC/AML providers; vendor should be fluent in regulatory workflows.

Ecommerce & Embedded Finance Integration

Experience exposing banking services via APIs, SDKs, or white-label modules for marketplaces, platforms, and merchant partners.

Post-launch Support & Growth Vision

SRE/DevOps, observability (distributed tracing, metrics, alerts), SLOs/SLAs, and a roadmap for feature growth (lending, BNPL, reward engines).

Data Residency & Privacy Controls

Ability to configure data storage by region, support for GDPR/CCPA, and secure data retention policies.

Third-party Ecosystem & Partnerships

Pre-existing integrations with card processors, payment rails, core banking vendors, and compliance vendors reduce time-to-market.

Business Continuity & Financial Stability

Vendor must demonstrate operational continuity (redundancy, disaster recovery) and references from regulated financial clients.

Here’s Your Go-To Checklist to Choose the Best Digital Bank / Neobank App Development Company

Has proven experience building live digital bank or neobank platforms (not just fintech apps).

Can demonstrate end-to-end banking workflows (accounts, ledger, payments, reconciliation).

Uses API-first, cloud-native architecture with microservices or modular backend design.

Has experience handling high-volume, real-time financial transactions at scale.

Understands US / EU banking regulations and implements KYC, AML, PCI-DSS from day one.

Can integrate with sponsor banks, card issuers, and payment rails (ACH, SEPA, SWIFT).

Implements security by design (encryption, tokenization, MFA, secure key management).

Offers clean, frictionless onboarding UX optimized for financial apps.

Has experience with embedded finance and ecommerce-driven banking use cases.

Provides admin dashboards for compliance, reporting, and operational control.

Supports third-party fintech integrations (KYC providers, fraud tools, analytics).

Follows Agile delivery with clear milestones from MVP to full-scale launch.

Can show architecture diagrams and real production system references.

Offers post-launch support, monitoring, and performance optimization.

Understands data residency, privacy laws, and audit readiness (GDPR, SOC-2).

Has a clear scaling roadmap for new features like lending, BNPL, or rewards.

Provides transparent pricing and phased cost breakdowns.

Has strong client reviews and fintech-specific case studies.

Demonstrates long-term product thinking, not just development and delivery.

Wrap Up

Developing a digital bank or neobank app like N26 is a complex engineering and regulatory undertaking, not a conventional mobile app project. Success depends on ledger accuracy, transaction integrity, compliance automation, and scalable system design, all operating in real time under strict regulatory scrutiny.

As the U.S. and European neobanking markets expand rapidly, fintech founders and enterprises must move beyond prototypes toward production-grade, regulation-ready platforms. This requires development partners who understand banking workflows, payment rails, distributed architectures, and security-by-design principles, not just frontend development.

FAQs

Q1. What does it technically take to build a digital bank app like N26?

Ans. To build an app like N26, you need a core banking layer, ledger system, KYC/AML engine, payment rails integration, and a mobile-first frontend, all orchestrated via an API-first, cloud-native architecture. Beyond UI, success depends on transaction integrity, compliance automation, and scalability under real-time load.

Q2. How much does it cost to develop a neobank app in the US?

Ans. A production-ready neobank app in the US typically costs $150,000 to $500,000+, depending on whether you build a custom core banking stack or use white-label platforms, and how deeply compliance, card issuing, and payments are integrated.

Q3. How long does it take to launch a neobank app like N26?

Ans. An MVP can be launched in 4–6 months, while a fully compliant, scalable neobank platform usually takes 9–15 months, including regulatory readiness, security audits, and payment integrations.

Q4. What is the biggest technical challenge in neobank app development?

Ans. The hardest part is ledger accuracy at scale—ensuring idempotent transactions, reconciliation, and consistency across distributed systems while supporting real-time payments and concurrency.

Q5. Do neobank apps require a banking license to operate in the US?

Ans. Yes, but most startups operate via sponsor banks (Banking-as-a-Service models) instead of holding a full license, allowing faster go-to-market while remaining compliant with US banking regulations.

Q6. What compliance standards must a digital bank app follow?

Ans. At minimum: KYC, AML, PCI-DSS, SOC-2, encryption at rest/in transit, audit logging, and secure identity management. EU-focused neobanks must also comply with GDPR and PSD2/Open Banking.

Q7. What architecture is best for scalable neobank platforms?

Ans. Microservices with event-driven architecture (Kafka/SQS), CQRS, and separate ledger databases are best practices for handling high-volume financial transactions reliably.

Q8. Can neobank apps support embedded finance and ecommerce use cases?

Ans. Yes. Modern neobanks expose banking functions via APIs and SDKs, enabling embedded wallets, payments, BNPL, and merchant payouts inside marketplaces and ecommerce platforms.

Q9. What’s the difference between custom neobank development and white-label platforms?

Ans. Custom development offers full control and scalability, while white-label platforms reduce time-to-market but limit ledger flexibility, customization, and long-term differentiation.

Q10. How do digital banks handle fraud detection and risk management?

Ans. They combine rule-based systems, behavioral analytics, transaction monitoring, and third-party fraud APIs, often enhanced with machine learning models for anomaly detection.

Q11. Which regions are best to launch a neobank—US or Europe?

Ans. The US offers higher revenue potential, while Europe provides easier entry due to Open Banking and SEPA. Many fintechs launch in Europe first, then scale to the US.

Q12. What features are essential in a modern neobank app?

Ans. Must-haves include instant onboarding, digital wallets, real-time payments, card controls, transaction insights, and admin compliance dashboards.

Q13. How important is UX in digital banking apps?

Ans. Critical. Frictionless onboarding, fast transaction visibility, and intuitive financial controls directly impact adoption, retention, and regulatory trust.

Q14. What post-launch support do neobank apps require?

Ans. Continuous monitoring, security patching, regulatory updates, performance tuning, and feature expansion—neobank apps are never “done” after launch.

Q15. How do I choose the right digital bank app development company?

Ans. Choose a company with proven live neobank deployments, compliance expertise, ledger and payments experience, and the ability to scale from MVP to regulated production systems.