“Buy Now and Pay Later and Build trust in e-commerce at your convenience” – this was the one classical idea inspired by Swedish mail-order tradition.

Problem? Maybe 2005 was too soon for this idea! The digital market had not gained much trust yet.

Despite challenges and rejection of their idea, the Klarna team earned an angel investor, proceeded, and today the company is standing at $15 billion projected valuation.

$0 → $15 Billion in 20 Years – Checked.

These stats trigger an intriguing and beautiful case study(presented in this article) about the foundation of the Klarna business model, its foundation, revenue streams, and tech-cost framework, in case you want to build a Klarna like App in 2026.

What is Klarna and Why It’s So Popular?

Initially, it aimed to build trust among buyers by allowing them to pay only after they had received the goods and inspected them. This is a sort of developed idea based on the Swedish traditional mail-order system.

Klarna Overview – A BNPL Pioneer

Klarna is a Swedish fintech company that aims to provide financial services to facilitate online shopping in smarter ways.

They are based on the Buy Now and Pay Later (BNPL) business model. Now further tapping into the neobanking industry by giving cashbacks and Balance tools.

Klarna provides flexible payment options, including

- Pay in 4 – Split payment into 4 interest-free slots (charged every 2 weeks). Leading model in the US market.

- Pay in 30 Days – Pay under 30 days without any late fees/interest.

- Pay over time – Convert into smaller monthly payments ranging from 6 to 24 months.

- Pay in full today – Pay the full payment directly.

Behind the doors, Klarna pays retailers upfront for the purchases made by users and then receives money through the above 4 listed methods.

They serve both merchants and buyers by being an intermediary, allowing both parties to have flexible and convenient options. With the help of AI, they further create a secure ecosystem by taking digital underwriting for risk.

Take a look at key stats about Klarna:

| Founded In | 2005 (Stockholm, Sweden) |

| Revenue (2024) | $2.81 Bn (24% Increase YoY) |

| Active Users | 111 Million Active Users (as of Q2 2025) |

| Merchants | 724000 |

| Valuation | $15 Bn+ (early 2025 projection), Peaked at $45 Bn in 2021 |

| Estimated Transactions per day | 2.9m |

Global Reach and Market Penetration

Klarna has a strong presence, especially in the US, UK, and EU countries. Promoting itself as an AI-first company, tech employees grew from 36% to 52% from 2022 to 2025.

The App, launched in 2018, has gained more than 100 million downloads on different app stores. Furthermore, the company is now exploring neobanking services via cashback programmes and Balance tools.

To boost its global reach, the company has partnered with major brands such as Adidas, IKEA, etc., and payment gateways such as Stripe, JPMorgan Payments, and Nexi to expand its area of operations.

For business growth and market penetration, Klarna has introduced and is actively promoting its Card Adoption.

As per Klarna’s Press Release, “Italians are embracing Klarna: 1 in 10 are now active Klarna consumers, and we’ve secured partnerships with 40 of the top 100 merchants in Spain. ”

Klarna’s Role in Modern E-commerce

The fintech company is now one of the leading BNPL brands in the e-commerce industry. Worldwide, more than 60,000 merchants, including eBay, John Lewis, etc., are offering Klarna at checkout.

Even the other big stores, such as Amazon and Walmart, support payments through Klarna. Their business model not only helped customers to build confidence while online shopping but also offers a much convenient way to plan their budget.

Klarna Business Model – Behind the Curtains & How It Works?

Klarna acts as a facilitator between retailers and consumers. It includes various components to simplify the payment process, embedded checkout, and real-time risk management.

Here’s the detailed business model analysis of Klarna:

BNPL Model: Pay in 4, Pay Later, Monthly Financing

Klarna offers payment solutions in these formats:

Pay in 4: It is one of the most widely used payment methods among Klarna users. It offers you instant checkout and then splits the bill into 4 installments, which are autocharged every 2 weeks. It stands out because:

- No fee is deducted if installments are made in time.

- Autodeducted every 2 weeks.

- Provides more flexibility in budget planning.

Pay Overtime: For bigger purchases, Klarna allows you to break the bill into smaller installments, which you can schedule between 6 – 24 months. Even during the installments, you have the option to opt for lower interest rates starting from 0%.

Pay in 30: Another convenient option, in which you can purchase a product without spending a penny at the moment. This option includes:

- Shop instantly and pay within 30 days.

- Pay only for the products that you keep.

- No charges if you are completing the payment under a 30-day slab.

Pay Full Today: All details pre-filled. This option allows you to pay instantly with secured Klarna’s buyer protection.

Merchant Relationships & Embedded Checkout

Keeping a close relationship with merchants is one of the essential aspects of this business model.

Since Klarna has partnered with more than 60,000 merchants worldwide, thus offers users an embedded checkout system.

With this integration, users can make Klarna payments via:

- Choose the Klarna badge at checkout.

- Apple Pay

- One-time Card Pay

- Klarna Credit Card

- Klarna App

Furthermore, here’s how Klarna maintains and processes payments with the merchants:

Customers purchase products using the 4 payment methods of Klarna.

↓

Klarna pays upfront to the merchants.

↓

Merchants send/sell products to customers.

↓

Customers then pay Klarna as per their convenience.

Klarna App Experience for Users

As discussed earlier, the app version was launched in 2018. Since its launch, the app has contributed to its growth trajectory. The app offers more convenience while making daily transactions. Some of the standout features of the app are:

- Integrated with 724000 merchants and 150000 new retail partners.

- Klarna at checkout, including eBay, John Lewis

- Offers exclusive deals on purchases.

- Seamless access to its neobanking features

- AI-powered Fintech Solutions

- Smoother experience.

Risk, Trust & Credit Decisions in Real Time – Finance Management Framework

Setting up a secure framework is yet another crucial pillar of Klarna-like Apps. Here’s how their finance management framework works:

- Making instant lending decisions at each transaction.

- Evaluation of the user’s affordability in real-time to minimize over-borrowing risk.

- AI for credit and fraud detection checks.

- An interest-free option reduces financial burden.

Klarna’s Revenue Streams – How Klarna Makes Money

The company’s revenue is divided into two parts –

- Transaction and Service Revenue (76% of total revenue)

- Interest Income (24% of total revenue)

| Klarna’s Revenue Streams (As of 2024 Reports) | |

| 1. Transaction and Service (76% of total Revenue) | Merchant Revenue (75% of 1) |

| Advertising Revenue (8% of 1) | |

| Consumer Service Revenue (16% of 1) | |

| 2. Interest Income (24% of total Revenue) | Fair financing products having a duration of more than 3 months (Pay in Full and Pay Over Time excluded). |

Here’s a detailed breakdown of Klarna’s revenue streams (All rates are as per 2024 data):

1. Transaction and Service Revenue

a) Merchant Commission (2.77%)

Klarna generates a major share of revenue from merchants.

On every purchase order, they keep 2.77% (as of 2024) of every payment. In simpler words,

If you are ordering a product worth $100 using their platform, Klarna will pay $97.33 to the merchants. So when you pay later to Klarna, they will earn $2.77.

b) Late Fee Income (Consumer Service Revenue)

Another source of revenue is charging a late fee to consumers. Whenever a consumer fails to pay within the described time, they are charged accordingly, depending on the amount of the order. It is worth noting that fees vary by geography and payment options.

c) Advertising & Affiliate Revenue

By placing sponsored ads and affiliate placement of different brands in their app.

2. Interest Income

Klarna charges interest in the following scenarios:

When a consumer chooses to opt for the “snooze” feature to delay the cost of the transaction or spread payments using their interest-bearing financial products

Klarna also generates a share of revenue by providing fair financing products. These products include:

- Methods having a duration of more than three months.

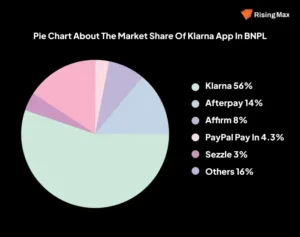

Klarna’s Competitors and Market Trends

Once Klarna rose to the limelight, many other competitors started adapting to this very fintech startup idea, including giants such as PayPal. However, most of them come with some amount of limitations.

Klarna vs Key Players – Afterpay, Affirm, Sezzle, Zip

| Feature / Player | Klarna | Afterpay (Block) | Affirm | Sezzle | Zip |

| Active Consumers | 100M+ (Q1 2025) | ~20M+ | ~18M+ | ~4M+ | ~12M+ |

| Merchants | 724,000+ | ~144,000+ | ~266,000+ | ~97,000+ | ~90,000+ |

| Core Product | Pay in 4,

Pay in 30, Pay over time, Klarna Card, Cashback, Balance tools |

Pay in 4 (interest-free) | Pay in 4, Longer-term loans (3–36 months) with APR | Pay in 4, “Sezzle Up” (credit-building) | Flexible installments (weekly, bi-weekly, monthly) |

| Market Presence | 26 markets (global) | Australia, U.S., UK, Canada, EU | U.S.-centric, expanding in Canada & Australia | U.S. & Canada (smaller scale) | Australia, U.S., UK, NZ, EU |

| Neobanking Features | Yes – Klarna Card, Cashback, Balance tools, everyday spending partner | No | No | Limited (credit-building only) | Limited (wallet + installments) |

What sets Klarna as a BNPL Differentiator?

As evident from the table, Klarna is already a winner in this race. Not because they just entered early in the market, but the way the company scaled up and opted for smart technologies while keeping operational frameworks steady.

Overall, Klarna offers a combination of BNPL + neobanking + AI-powered effective financial solutions.

While the competitors are mostly limited to a few countries, Klarna has successfully increased its landscape across 26 countries.

Furthermore, its vast network and partnership with major brands such as eBay, Walmart, Nike, IKEA, Sephora, and others helped to gain trust among its customers.

2026 Trends – AI Credit Decisions, Crypto Checkout, BNPL Subscription

Before analyzing the future trends, it is important to take a look at how consumers’ payment behaviour is evolving:

- According to PYMNTS, card usage has shifted to debit cards from credit cards.

- Gen-Z generation and Millennials, who have grown up in a technological world, love to opt for options that offer them more control and transparency.

- Digital payments or Contactless payments are gaining the full momentum than before. Thus, allowing BNPL payment models to fill the vacuum.

Therefore, the future of payments and transactions is heading towards:

- BNPL service providers are adopting AI-driven underwriting, making the assessment of large amounts of user data easy and accurate.

- Usage of AI and ML for risk and fraud assessment

- BNPL players are also focusing on crypto payment, blockchain technology, and web3 payment ecosystems.

- For higher customer retention, many players, including Klarna, are looking to introduce new features such as integrating BNPL model apps for recurring expenses.

Recommended Features You Need in a Klarna like App in 2026

The reason why the Klarna App performed so well just after its launch is the set of features they provided + user experience, combined with continued research towards providing a seamless and integrated experience under one roof.

If you are planning to build a Klarna app clone or any BNPL-based app like Klarna in 2026, it is highly recommended to keep it future-ready while following government and local laws compliance.

Below are some of the recommended features(but not limited to), that you should consider including.

Tips: We will cover these features from three different angles – user side, merchant side, and app management side.

User Panel

- KYC verification: Users should be able to verify their identity and complete their KYC with their nationally authorized identity proofs.

- Flexible Payment Options: Like Klarna, consider providing different payment options, such as Pay in 4, Pay Later in installments, and Pay Now.

- Affordability Checks: With the help of AI, users should be able to check and calculate their affordability during the checkout procedure.

- Payment Related Notifications: Users should be able to get notifications and reminders about the installment schedules, due dates, flexible rescheduling (e.g., snooze feature of Klarna App), and an option for early payments.

- In-App Personalization: Users should be able to create or get a curated list of products based on previous behaviour. Add those products to the wishlist for later purchases. This can be done with the help of AI and ML.

- Smoother Payment Experience: To boost user experience, enable features like one-click checkout and cross-border payments.

Furthermore, to provide a native experience to users, consider adding multilingual support and even referral programs to spread business.

For Merchant Panel

Your next goal should be to provide a hassle-free experience for merchants who will be managing their business on your app.

- Easy integration of eCommerce Stores: Plug-and-play integration of websites built on platforms like Shopify or WooCommerce. For custom-built stores, provide an easy API integration option. This integration should come with an option to maintain a real-time inventory management system.

- Sales Tracking: Merchants should have access to a dashboard where they can get analytics about the sales, previous order history, and demography-wise purchase patterns.

- Advance Analytics: To monitor and strategize sales by analyzing GMV (Gross Merchandise Volume), conversion rate, and average order value.

- Payment Integration: Track and see the status of order payments.

- Track Order Status: Should be able to track the status of the order deliveries. In case of any product discrepancies, they should be able to provide support and assistance, including refunds, cancellations, or partial refunds.

- Ad Campaigns: To promote their online business, merchants should be able to create and actively track their Ad Campaigns, or may be able to send promotional notifications such as price drops, hot in season, etc, if users opt for any.

Admin Panel

Admin Panel is created to manage both users as well as merchant-side data. It includes features like:

- Dashboard Analytics: A dashboard home in which app managers can access key data related to the app. It may also include access to users’ data, merchants’ data, app analytics, transaction panel, control over integrated AI models, and others.

- Payment Plans Customization: Able to customize payment plans as per their business strategy.

- Risk and Fraud Management: Since in the BNPL model, service providers take the credibility and pay merchants upfront. Therefore, it is extremely important to monitor each transaction on the basis of various assessments to prevent over-debt or any fraud cases.

- In May 2019, Klarna got into muddy waters with allegations that Identity thieves are using Klarna to commit fraud. However, in 2022, the company stated that its risk and fraud prevention tools are as strong as those of banks.

- Encryption of Sensitive Data: While the admin panel does have an advantage in tracking and monitoring users’ data, but is extremely important that the personal data stays encrypted.

Some Advanced Features to Make Your Klarna Like App Clone Future Ready

As per a case study, Gen Z and Millennials are the major contributors who prefer using future-ready solutions such as BNPL. Therefore, to compete and win this fintech market, you should keep a keen eye on some of the advanced features.

- Virtual and Physical BNPL Cards for a unified solution for both online and offline payments.

- Integration of the BNPL model with services like traveling, movie tickets, and restaurants with added benefits. Even several existing banks are now exploring ways to give these benefits.

- AI-powered spending analytics and future budget planning as per user history.

- 24*7 support system.

- Integration with neobanking tools such as Balance Tracker and budget insights.

- Enabling crypto wallets or stablecoin checkout.

- BNPL for subscription and memberships.

Klarna-like App Tech Stack & Architecture Overview

Choosing the right technology stack that not only provides a smooth experience throughout but also is scalable is another pillar that requires careful planning.

Here’s the recommended tech stack that you can opt for your Klarna app development:

Front-End

Frontend is responsible for client-side interactions. In this case, it is for both users as well as merchants. It provides a smooth platform via mobile apps or websites through which users can access services. Similarly, merchant users also need to interact with the app to maintain their stores and facilitate product and payment transactions.

Here’s the recommended technology stack for frontend –

| Technology | Remarks |

| React | Flexible, Reliable, Component-driven – Good for UI |

| Flutter | Single Codebase for both iOS and Android. Faster Solution. |

| Swift | Native iOS feel. |

| Kotlin | Native Android feel. |

Back-End

Backend means operating server-side functions such as user management, handling authentication and verifications, setting up algorithms and APIs for fluid payment, and sharing of data.

Furthermore, the backend is also responsible for managing services like push notifications, reporting, security tools integration, and large payment handling.

The preferred tech stacks to build a Klarna-like App are:

| Technology | Remarks |

| Node.js | Scalable, event-driven, perfect for real-time payment processing. |

| Django | Secured, rapid development. |

| Ruby on Rails | Easy setup, suitable for fast development of MVP |

Database

The database is responsible for storing user, transactional records, merchant data, and any other critical data. The database also manages relations such as 1:1 or 1:N for financial compliance entities.

Here are some recommendations for databases:

| Technology | Remarks |

| PostgreSQL | Advanced relational queries for financial data, Consistency |

| MongoDB | Flexible, good for storing unstructured data such as merchant and user activity. |

Integrations

To make transactions smooth and secure, you can integrate APIs.

| Technology | Purpose |

| Stripe | Global, support merchants at scale. |

| Plaid | Bank account connectivity. |

| IDology | Identity verification and KYC compliance. |

| Sift | Behavioral Analytics. Fraud and Risk Management. |

| AWS | Scalable cloud services infrastructure. |

AI/ML Integration (Futureproof Solutions)

As discussed earlier, AI and ML can help to make your app future-ready by enabling a personalized shopping experience, real-time tracking against fraud detection.

| Purpose | Technology |

| Frameworks | PyTorch, TensorFlow, Scikit-learn (for credit scoring, fraud detection). |

| MLOps | MLFlow, Kubeflow, or AWS SageMaker for training + deployment |

| Recommendation Systems | TensorFlow Recommenders / LightFM for personalized shopping. |

| NLP/Chatbots | Rasa, Dialogflow CX, or GPT-based APIs for AI-powered customer support. |

| Fraud & Risk | Graph Neural Networks (PyTorch Geometric) for fraud ring detection. |

Security & Compliance

Here are some security management keys and web tokens that will ensure compliance with rules for financial security.

| Purpose | Technology |

| Authentication | OAuth 2.0 / JWT (JSON Web Token) |

| Secure key management | Vault / AWS KMS (Key Management Service) |

| Card Payments | PCI – DSS Level 1* |

| European Markets | GDPR / PSD 2 readiness |

* Payment Card Industry Data Security Standard (Level 1 = highest level of compliance for handling cardholder data) – [PCI – DSS].

How a BNPL App Like Klarna Works (Step-by-Step Flow)

Klarna like App Development Cost Breakdown

The development cost of a Klarna app clone depends on the level of complexity. Below is the cost estimation for building a Klarna-like app.

| Module/Feature | Estimated Cost (USD) | Timeline |

| UI/UX Design (User + Merchant + Admin) | $6,000 – $10,000 | 2–3 weeks |

| BNPL Logic & Credit System Integration | $10,000 – $18,000 | 3–5 weeks |

| Payment Gateway & Fraud Detection | $7,000 – $12,000 | 2–3 weeks |

| Merchant Dashboard | $4,000 – $7,000 | 2 weeks |

| Admin Portal & Reporting | $5,000 – $8,000 | 2–3 weeks |

| KYC/AML + Compliance Engine | $8,000 – $12,000 | 3–4 weeks |

| Notifications, Alerts, & Reminders | $2,000 – $4,000 | 1 week |

| Testing, QA & Launch | $5,000 – $7,000 | 2–3 weeks |

| Total Estimated Cost (MVP) | $47,000 – $78,000 | 8–12 weeks |

| Total Estimated Cost (Full Product) | $90,000 – $140,000+ | 14–20+ weeks |

US-based development rates; offshore teams can cut costs by 40–50%

Timeline to Build a Klarna like App

The time required to build an app like Klarna depends on the app structure, level of complexity, and tech stack chosen. Here are the stages and timeline required for Klarna app development.

Note: This is a rough timeframe. Actual time for these stages may vary!

Discovery & Requirements – (Est. Time: 2–3 weeks)

Structuring the basic idea about the app features and requirements is the foremost and most complex process. This stage includes preparing a framework, deciding on app complexity, and various features.

A discussion about choosing the right tech stack after consulting professionals is also included in this stage.

So it is important to consult a team of professionals who have experience in

- defining app scope,

- help you identify the target audience,

- have knowledge of financial regulations,

- marketing strategies to maximize your revenue,

- And expertise in various technology stacks discussed above.

Depending on the complexity, the time required for discovery and requirements may vary between 2-3 weeks.

UI/UX & Architecture – (Est. Time: 3–4 weeks)

UI/UX is one of the deciding factors for:

- New customer (buyers + merchants)

- Retaining customers

- Usage

- Experience

Therefore, while considering a UI/UX wireframe (or more detailed Figma), keep 2-3 different prototypes in front of you. Furthermore, you can also go for A/B testing to check which one is more efficient.

Along with the UI/UX wireframe, the database schema is also designed to pin relations.

Development (Core Modules) – (Est. Time: 8–12 weeks)

This stage includes building the whole app and finalizing it for final testing. Depending on the team size, development time can fluctuate. A larger team can deliver a project in a short timeline with high accuracy.

Also, with a professional Klarna like app development company, you have dedicated professionals to handle every stage efficiently.

Depending on the level of complexity of the app and team size, Klarna-like app development may take anywhere between 8-12+ months.

- Estimated time for MVP, i.e., Core modules (Minimum Viable Product) – 8-12 months.

- Moderate and Advanced features may take up to 12-24 months.

Testing & Launch – (Est. Time: 2–3 weeks)

Once your app is built, comes the rigorous testing, including the one in live scenarios. Please ensure to run a deep security check of the accuracy of users’ information, including the secure processing of transactions.

Once the testing is done, you can either launch your product on a full scale or opt for a beta launch with selected merchants.

Post-Launch Support – (Est. Time: Ongoing)

Post-launch support continues in action till the time your app is online and functioning. It includes bug fixes, continuous monitoring of existing features, AI model training for creating a more secure environment, and R&D for adding new features.

Why Klarna-like BNPL Startups Are Thriving in the USA

As per a study revealed by Straits Research, the global BNPL market is expected to grow from USD 51.74 billion in 2025 to USD 435.25 billion by 2033.

And Klarna is one of the leading BNPL fintech service providers in the USA. If we look at the evolving shopping patterns, buyers are looking for more convenient payment options and better control while planning their budget and spending.

Fintech service providers based on Buy-Now-Pay-Later, provide exactly that. It enables consumers even buy expensive products without having too much financial burden.

Here are a few arguments that explore why Klarna-like startups are thriving in the USA:

Millennials & Gen Z Prefer Flexible Payments

Gen Z and Millennials prefer more flexible and transparent payment options. As BNPL methods provide greater self-control over spending and interest-free installments, today’s generation is loving and adapting quickly to this market.

Furthermore, BNPL startups like Klarna address the issue of debt revolving, leading to better budget planning and reduced financial stress.

Embedded Finance for E-commerce Growth

Klarna has already shown that embedding finance with BNPL is the door to a new order of the financial market.

- BNPL leads to more spending, which in result causes boosted cart conversion.

- Klarna is a classic example that how BNPL startups, by partnering with e-commerce giants such as DoorDash or eBay, can lead to huge success.

Huge Scope for Niche BNPL (Healthcare, Education, Travel

Klarna is exploring new ways to integrate its BNPL model into a wide range of services, including the essential ones such as medical expenses, travel booking, and tuition fees.

- BNPL also has the potential to tap into the financial ecosystem by providing effective solutions powered by AI and ML modules.

- Further integration of BNPL fintech services with crypto and web3 technologies, users can expect a more diversified and frictionless experience than ever.

It won’t be wrong to expect the expansion of BNPL beyond retail stores in the near future.

Work With Us – Your BNPL App Development Partner

The success of a business lies in its foundation.

Building a complex BNPL app like Klarna, you ought to collaborate with experts who have adequate professional experience to handle various developmental stages and the framework of your business plan.

RisingMax – AI mobile app development company has been providing startup, medium, and large-scale enterprise-grade solutions since 2011. The company has expertise in developing BNPL apps, neobanks, and secured payment systems, coupled with the latest blockchain technologies. Here’s what makes RisingMax your go-to option:

- 500+ happy clients; 1000+ projects experience.

- Provides MVP in 10-12 weeks with the option to scale all the way up to the most advanced features.

- PCI-DSS, GDPR, SOC2 Readiness

- Agile-based delivery with risk engines (AI/ML)

- 24*7 professional support

How we do what we do:

Final Thoughts – Klarna as a Business Model Blueprint

Klarna’s business model blueprint tells,

- Start Lean

- Build Smart

- Grow Fast

The very fintech startup idea that was initially discarded by investors became today’s leading example of the BNPL business model.

Klarna has proved that the BNPL model, if implemented in a systematic way while integrating future-ready options, is scalable and profitable.

As we discussed in the case study done above, the future of this business model lies in providing more comprehensive fintech solutions. By giving more control to users to manage their finances, such fintech startups can gain more user trust, which is highly beneficial in the long run, as evident from Klarna’s success journey.

FAQs

What is Klarna’s business model?

Ans. Klarna is based on Buy-Now-Pay-Later, in which the fintech company acts as a mediator between merchants and buyers: it pays merchants up front for purchases and then collects from consumers according to the plan chosen (Pay in 4, Pay in 30, Pay over time, etc).

How does Klarna make money from merchants and users?

Ans.

- Merchants: Klarna charges a merchant fee (a “take rate”) on each order. 2.7% as of 2024!

- Users/Consumers: revenue comes from

- interest on multi-month financing products,

- late/returned-item fees for some products,

- consumer-facing services (e.g., card interchange, premium features).

What features are required in a BNPL app like Klarna?

Ans. User: onboarding + KYC, multiple payment options (Pay in 4, Pay in 30, financing), easy integrations (Shopify/WooCommerce/API), payouts/settlement dashboard, dispute & returns handling, campaign/ads tools.

Admin / Ops: merchant & user management, strong encryption, and financial regulations compliant.

How much does it cost to build a Klarna-like app?

Ans. Klarna-like BNPL app development cost varies between $47K to $78K, and can be delivered between 8-12 weeks. While the advanced features may cost up to $9k – $140k.

Can a startup build a similar BNPL platform in the USA?

Ans. Yes — technically and commercially it’s possible. With proper planning and an effective team, you can build a similar BNPL platform.

What are the compliance requirements for BNPL apps?

Ans. BNPL apps must implement KYC/AML, PCI-DSS card security, and comply with data privacy laws like GDPR or CCPA, where applicable.

What tech stack does Klarna use?

Ans. Klarna uses cloud-based solutions and a custom-built system. Klarna’s tech stack is:

- Application and Data: Python, Node.js, React, Typescript, GraphQL, AWS Lambda, Erlang, Amazon EC2, and Scala.

- Utilities: Stack Overflow

- DevOps: Kubernetes, Bitbucket, Sentry, AWS Elastic Load, Datadog

- Business Tools – Slack, Jira, G Suite, Confluence

What is the best payment gateway for BNPL apps?

Ans. Stripe, Adyen, Worldpay, J.P. Morgan Payments, or Nexi. Payment gateway selection depends on your app’s build and framework.

How long does it take to develop a Klarna-style app?

Ans. Core MVP (user + merchant checkout + basic underwriting): 3–6 months with a focused cross-functional team (product, 2–4 engineers, 1 data scientist, QA, devops)

Production-grade product (card, deposits, multi-market compliance, securitization, full risk & collections): 9–24+ months.

Who are Klarna’s biggest competitors in 2026?

Ans. Major competitors (global and U.S.-focused) include Affirm, Afterpay (Block), PayPal (Pay in 4 / Pay Later), and Zip / Sezzle.

What is the difference between Klarna and Afterpay?

Ans. Klarna offers multiple products — Pay in 4, Pay in 30, longer-term financing, Klarna Card, and neobanking features; Afterpay historically focuses primarily on the Pay-in-4 short installment product.

Can I build a Klarna-like app for a niche industry?

Ans. Yes — BNPL readily verticalizes. Niche BNPL markets (travel, healthcare, education, subscriptions) are attractive because you can tailor underwriting, product terms, and partnerships to the vertical’s cash flows and seasonality.