RisingMax Inc. is a trailblazing UPI (Unified Payments Interface) development company at the forefront of revolutionizing digital financial transactions. Establishing itself as a pioneering force in the fintech industry with a relentless commitment to innovation and cutting-edge technology. Our team of experts is dedicated to crafting seamless, secure, and user-friendly UPI solutions that empower businesses and individuals alike.

We leverage our deep understanding of the financial ecosystem to create tailored, future-proof UPI applications that streamline payments, enhance financial inclusion and drive economic growth.

What Is Unified Payment Interface (UPI)?

The Unified Payments Interface (UPI) is a transformative digital payment system that has revolutionized financial transactions in various countries. UPI serves as a real-time, instant payment platform, enabling individuals and businesses to seamlessly transfer funds, pay bills, and make purchases using their smartphones or computers. Developed by the National Payments Corporation of India (NPCI), UPI has gained widespread popularity due to its simplicity and interoperability.

UPI operates on a unique virtual payment address (VPA) system, eliminating the need for traditional bank account details during transactions. Users can link multiple bank accounts to a single UPI ID, making it convenient to switch between accounts. This innovation has accelerated the adoption of digital payments and driven financial inclusion, allowing millions of people to access and participate in the modern financial ecosystem, ultimately transforming the way payments are made and received.

Also Read: White Label Neo Banking Platform

Stats To Show The Demand & Market Of UPI

- Unified Payment Interface recorded about 9.33 billion transactions globally in June 2023.

- Countries like Singapore, Nepal, Bhutan, and France use UPI services for instant transactions. This helped to set the milestone of 76.28% P2P transactions in June 2023.

- Just in June 2023, Unified Payment Interface recorded 9.33 billion transactions. In the second quarter of 2023, it recorded a total transaction rate of 43.22 billion.

- By the end of June 2023, there were ₹ 14.75 trillion, about 1773682780 USD.

Why People Choosing UPI Over Bank Transfer

People are flocking to UPI (Unified Payments Interface) for its unparalleled convenience and speed over traditional bank transfers. With UPI, you can transfer funds instantly using a mobile number or UPI ID, eliminating the need for complex bank details. It operates 24/7, making transactions effortless and efficient, even on weekends and holidays. UPI apps offer additional features like bill payments and cashback, making it the preferred choice for modern, hassle-free digital payments.

RisingMax Inc.’s UPI development team crafts cutting-edge solutions to streamline transactions and enhance user experiences.

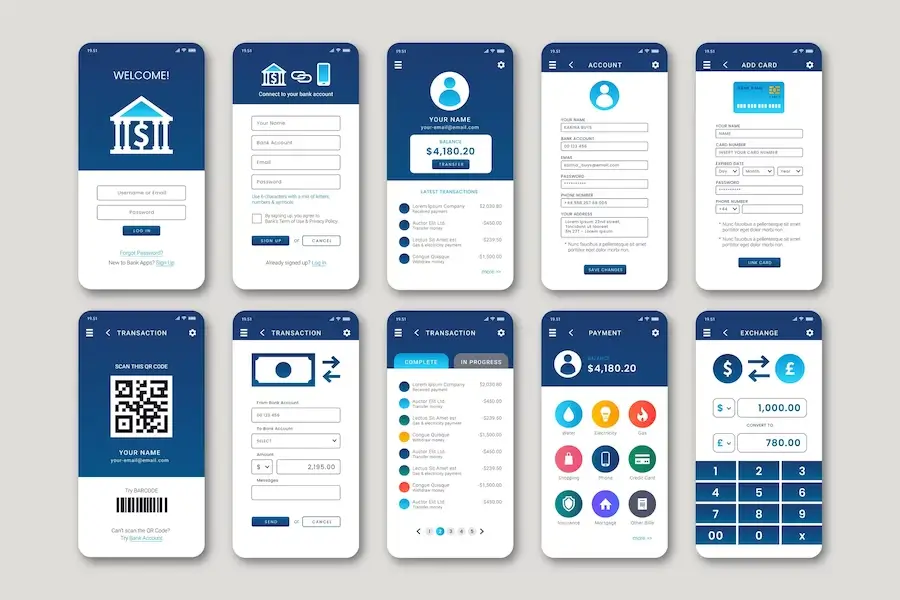

UPI App Development Features

Here are a few of the features of the UPI application that will help your business in user engagement and provide error-free transactions without failure and cyber attacks.

Virtual Payment Address

Users can create a unique VPA, eliminating the need to share bank account details for transactions.

Interoperability

UPI works seamlessly across various banks and financial institutions, facilitating transactions between different providers.

Real-Time Transactions

Payments and transfers through UPI occur instantly, ensuring quick and efficient transactions.

24/7 Availability

UPI services are available around the clock, allowing users to make payments and check balances at any time.

Multiple Bank Account Linking

Users can link multiple bank accounts to a single UPI ID, providing flexibility in managing finances.

Bill Payments

UPI supports utility bill payments, including electricity, water, and gas bills, making it a versatile platform.

Merchant Payments

Users can easily make payments at retail stores, restaurants, and online shops that accept UPI.

QR Code Payments

UPI enables payments by scanning QR codes simplifying transactions at physical stores.

Request Money

Users can send payment requests to others, streamlining the process of splitting bills and requesting funds.

Also Read: Crypto Banking Solution Provider

Benefits Of UPI App Development

Simplified Digital Transactions

UPI app development simplifies digital payments, making it easy for users to transfer money, pay bills, and make purchases with just a few taps on their smartphones.

Enhanced Financial Inclusion

UPI has played a significant role in expanding financial inclusion by providing access to banking and digital payment services to previously underserved populations.

Reduced Cash Dependency

UPI encourages cashless transactions, reducing the need for physical currency and promoting a more transparent and accountable financial ecosystem.

Interoperability

UPI apps are interoperable across various banks and financial institutions, promoting a unified and convenient payment experience.

Cost-Effective

Developing UPI apps can be cost-effective for businesses, as they eliminate the need for traditional Point of Sale (POS) systems and associated hardware.

Instant Settlement

UPI transactions settle in real-time, ensuring that businesses and individuals receive funds immediately, reducing waiting times, and improving cash flow.

Also Read: How Much Does It Cost To Start A Bank In USA

Security

UPI app development focuses on robust security measures, including multi-factor authentication, to protect users’ financial data and transactions.

User Engagement

UPI apps can offer additional features such as transaction history, account management, and notifications, enhancing user engagement and loyalty.

Market Expansion

Developing a UPI app can open doors to a vast user base, tapping into the growing trend of digital payments and e-commerce, thereby expanding market reach and potential revenue streams.

RisingMax Inc.’s UPI development team crafts cutting-edge solutions to streamline transactions and enhance user experiences. Join hands with us and empower your business with the latest in digital payments.What Else You Can Be Integrated In UPI Payment Application

In the payment application, here are a few of the other services you can integrate to make a one-stop solution for the user.

Flight Booking

You can tie up with airline companies to avail the option for the user to book the flight tickets from your platform.

Electricity Bills

You can also provide the service for the users to pay electricity bills from your platform in a few taps.

Recharge

The option to pay the bills of WiFi or mobile will help you to get good user engagement on the platform.

Insurance Channel

Integrating the feature of paying life/vehicle/accidental/medical, etc. insurance premiums will also help your user to get one one-stop solution.

Loan Repayments

Integrating the loan repayment option from your UPI payment application will also cover a huge user base, and in exchange, you can provide coupons or other rewards.

Bank Transfers

You can also provide the bank transfer option to cover the maximum user base and to provide services to those who are not available on your platform.

Also Read: What Is The Market Size Of Digital Banking

Perks We Offer In UPI Development Process

Here is the list of benefits RisingMax Inc. provides as a leading UPI app development company.

Satisfying Customer Needs

Our team of experts helps the company execute the business plan and also help to understand the need of the users that is lacking in other application. Our UPI app developers help to build the feature with perfection.

Offering Quality

Risingmax Inc. UPI developers deliver the project with high end features and secured coding to give an error-free transaction and free from any cyber scam.

Cross Platform Features

We provide UPI payment app development with cross platform features so that it can easily be accessible on any operating system.

Safer International Transactions

We also provide the integration of an international payment system with which your user can make lightning-fast payments across borders.

Secure P2P Transaction

We offer the UPI app with the P2P transaction system to keep payment safer and secured from cyber attacks.

Instant Billing & Invoice

We offer the UPI payment app with instant billing, invoices, and notifications so that user can easily track their payments.

Also Read: Fintech App Development

Top 6 UPI Payment Application

- Google Pay(GPay)

- PayTM

- PhonePe

- BHIM App

- Axis Pay

- CRED

If you want an app similar to the mentioned above application, then you are on the correct platform., RisingMax Inc. can provide a high-end and secure application like the top applications

Unlock the potential of UPI technology with our expert development services.

Elevate your payment systems, increase efficiency, and stay ahead in the competitive market.

UPI App Development Procedure RisingMax Inc. Follows

Here are the six steps we follow as the UPI development company to deliver the best solution to our client.

Planning and Research

– Define your app’s objectives and target audience.

– Research the UPI ecosystem and understand the regulatory requirements.

– Identify your competitors and analyze their apps.

Design and User Experience (UX)

– Create wireframes and prototypes for your app’s user interface.

– Focus on intuitive navigation and a user-friendly design.

– Ensure compliance with UPI guidelines for user security.

Development

– Choose the appropriate technology stack for your app (e.g., mobile app development framework, backend technologies).

– Implement UPI payment APIs.

– Integrate security features like two-factor authentication (2FA) and encryption.

Testing

– Conduct rigorous testing to ensure the app’s functionality and security.

– Perform compatibility testing across various devices and platforms.

– Verify compliance with UPI regulations and security standards.

Launch and Deployment

– Submit your app to app stores (e.g., Google Play Store, Apple App Store).

– Promote your app through marketing channels to attract users.

– Monitor app performance and user feedback post-launch.

Maintenance and Updates

– Continuously monitor for security vulnerabilities and address them promptly.

– Regularly update the app to add new features, improve performance, and fix bugs.

– Stay updated with changes in UPI regulations and adapt your app accordingly.

UPI app development also involves adhering to strict security and privacy guidelines to protect user data and financial transactions.

Also Read: P2P Lending Platform Development

UPI App Development Cost

The development cost of any of the applications majorly depends on the features of the application, the technology being used in the development, the size of the company you are hiring for the development, etc.

| Designing Cost | 08K To 10K |

| Outsource Software Cost | $15K To 25K |

| Deployment Cost | $7K |

| Integration Cost | $10K |

| Maintenance Cost | $1,500 To $4,000/month |

| Project Manager Hourly Cost | $25 To 49/Hour |

| Quality Assurance Team And Testers | $5K To $10K |

The approximate cost to develop an UPI payment app will be around $35,000 to $50,000. It can be more or less according to the features and other factors.

Also Read: Top 10 UPI Finance App Development Companies

Conclusion

RisingMax Inc. stands as a pioneering UPI development company committed to revolutionizing digital payment experiences. With their unwavering dedication to innovation, user-centric design, and cutting-edge technology, RisingMax has emerged as a trailblazer in the fintech industry. Our passion for excellence and commitment to security ensures a promising future for UPI-based solutions, making us a trusted partner for businesses and individuals seeking seamless payment solutions.